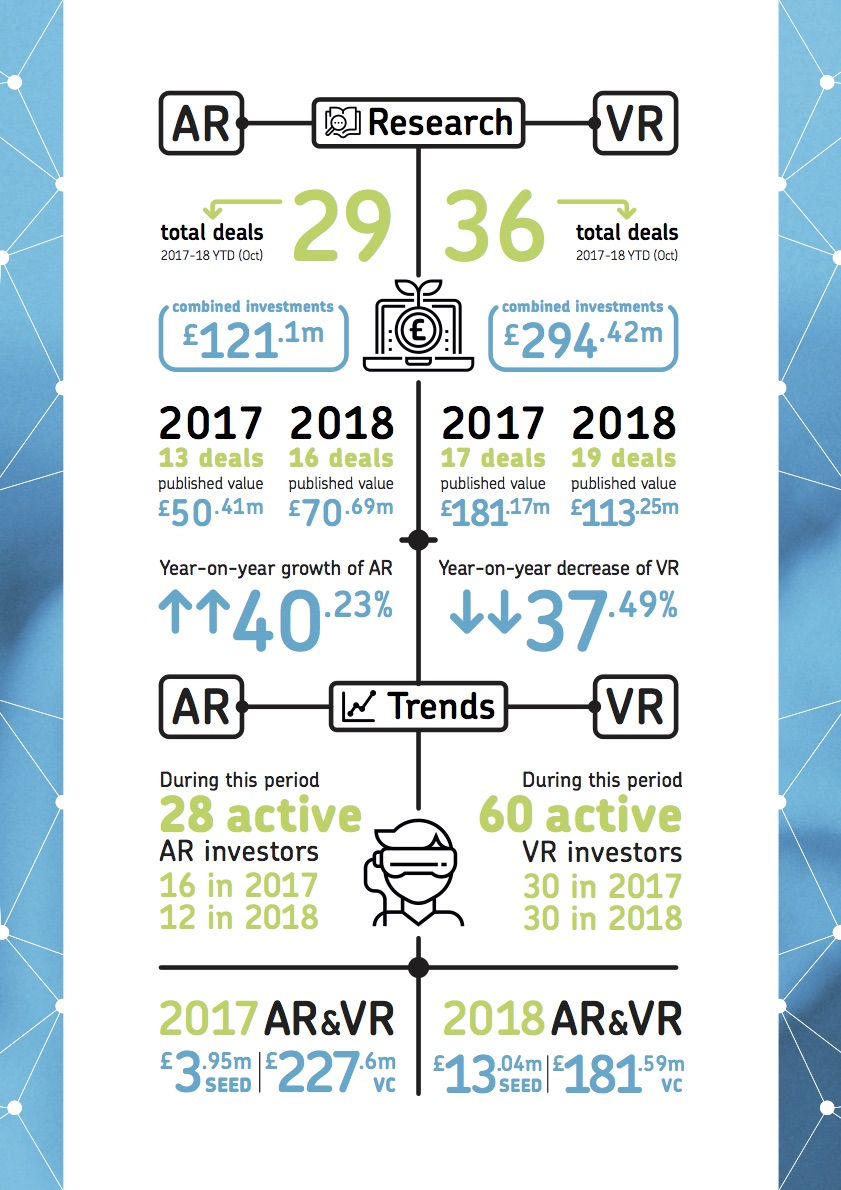

What are the trends in investment in the immersive tech sector? Our new infographic highlights the investment landscape in AR/VR from 2017-18.

Developed as part of the ISCF Audience of the Future Challenge in association with The Accelerator Network.

UK AR & VR Investment

- AR

Investment in the AR landscape increased by 40.23% from £50.41m to £70.69m. There were 3 more deals in AR increasing from 13 in 2017 to 16 in 2018.

- VR

Investment in VR has decreased by -37.49% from £181.17m in 2017 to £113.25m in 2018. However, the number of deals in 2018 increased by 2 from 17 in 2017 to 19 in 2018. It is interesting to see that even though funding amount in VR has decreased the number of deals have actually increased highlighting that on average the deal size have decreased per VR deal. Number of active VR investors have remained constant at 30 from 2017 to 2018.

- AR and VR hybrids

Investment in AR&VR (hybrid companies who are delivering an AR & VR solution – not AR plus VR together) overall decreased by -15.94% from £231.55m in 2017 to £194.64m in 2018. However, seed funding overall in AR&VR has increased from £3.95m in 2017 to £13.04m in 2018. Whereas, VC funding in the AR&VR market has decreased from £227.60 in 2017 to £181.59m in 2018. U

International AR/VR startups

Globally over $6 billion was raised across AR/VR/computer vision in 2018, driven by large, late-stage deals in China (Source: Digi Capital). Deal volume was lower in the first 3 quarters of the year but both deal volume and value returned to a 2 year average by Q4. The stages which declined the most remain pre-seed and seed deals.

UK startup funding activity

Across the rest of the UK startup landscape, deal numbers dropped 10% Year on Year down to 1,572 in 2018, and amount invested fell from £8.6b to £7b respectively. (Source: Beauhurst)

You might also be interested in…

- Find out more and apply for the Audience of the Future Investment Accelerator

- Visit our Online Guide to Funding and Finance for Immersive Technology for a comprehensive guide of UK investors